With the new year comes all the usual resolutions such as giving something up, starting something new, or vowing to establish a new hobby. After the spending around the Christmas holidays, it might be worth getting your finances in order. So consider a resolution that is worth sticking to in 2019.

Choose a Spending Goal

Everyone could do with being more thoughtful about their spending habits, so take some time to consider what you want to achieve with your wallet in 2019. It is never too late to create good finance habits.

Whether you are saving up for a big purchase or perhaps are gathering business ideas for your own start-up will change how you approach your 2019 financial goals. Whatever it is, have a clear idea of what you want.

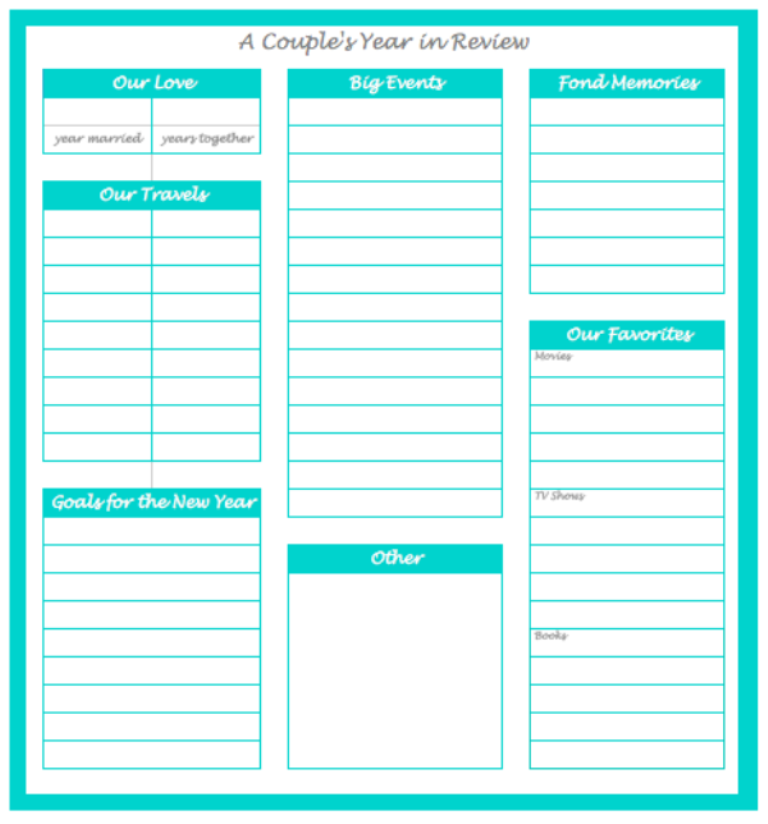

Make a Spreadsheet

If you have ever wondered where all your money disappeared to or how your bank balance depletes so fast, then consider tracking your spending by making a finance spreadsheet. Your spreadsheet does not have to be complicated. Start by making a list of all the main essentials that go out every month such as rent, gas, electricity and water. This is a good starting point for sensing how much you have left for groceries and other essentials.

Try to update this every day for the first month to really get a handle on when you are spending. Common sneaky culprits are online shopping, lottery tickets, take out coffees, and eating out. By taking one month to actively notice when you spend you can build awareness and make more conscious buying choices. Strategize your spreadsheet and make it work for you.

Reduce Your Debt

Be realistic about how much you can whittle down your debt in 2019 and then try to stick to it. Debt can be stressful if it gets out of control, so take steps early on to manage it. If you can manage to stick to a plan then your total debt will go down. Try not to add any new debts to the financial year.

Walking, Cycling, and Public Transport

Although personal vehicles are fast and convenient, the price of a car does not end at fuel. There are also repairs, licencing fees, and insurance to think about. If you think your vehicle is taking up too much of your income, then consider cheaper alternatives. Try an alternative for just one day of the week or try and arrange to ride share with a colleague. There are often social media groups for ridesharing.

Not only do cycling and walking help add some exercise into your day, they are also better for the environment and release fewer fumes into the atmosphere. Buses and trains emit less pollution than a personal car and you can usually buy monthly discounts.

The Right Insurance Deals

Insurance is a safety net for when the unexpected does happen. Nothing is more frustrating than having to shell out unexpectedly to fix a burst car tyre or replace a broken phone. Instead, take a look at some insurance quotes to find a manageable deal that fits in with your budget.

Although insurance can be a more expensive initial payment, it can really save you from larger payments in the future. As far as your finances go, it is a sensible move to start considering insurance plans in your yearly budget.

Find a Homemade Alternative

Socializing can often mean going out and spending way more money than you would if you took that activity to your home. This way you can also rotate households and swap who does the washing up. Plus, the mark up on at restaurants is huge and you will save on things like meat and alcohol.

Other activities like exercise classes can be swapped for free meet ups that you might need to hunt for on social media websites and nothing quite beats having a movie night. If you can slot some of these homespun alternatives into your month, then this can slowly curb the spending over the year.

Maybe you have a dream holiday you want to save up for or perhaps something smaller such as generally starting a savings account. Perhaps you just want to be more aware of where your money goes and support sustainable shops or small business. Whatever it is, make 2019 your year for smart finances.